PayrollPro / Web Pay Slips

A payroll system that can be adapted flexibly to meet complex requirements.

And, used with Web Pay Slips, you can dramatically reduce paper documents.

What is PayrollPro?

As a Cloud Solution, PayrollPro can be quickly connected to at any time. There's no need to be a payroll expert since we will do that for you. And, we automatically reflect all revisions to Japanese labor law on our Standard Services, including gross up calculations. Calculations results are automatically reflected on bilingual Web Pay Slips.

(salary, bonus, retirement allowance, and inhabitant taxes)

(PDF & Excel)

-

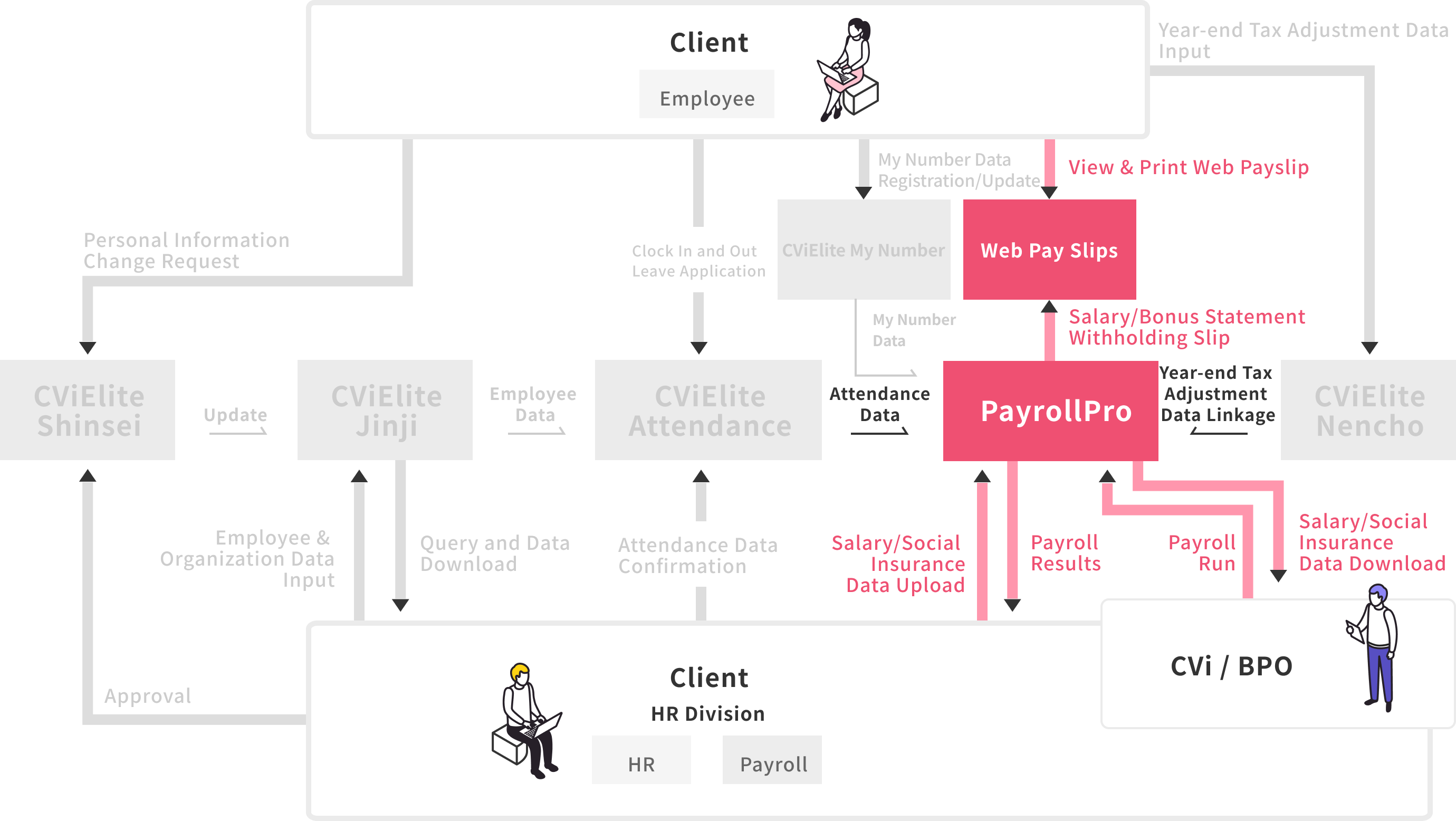

Information Sharing between Cloud Solutions

PayrollPro is easily integrated with other Cloud Solutions such as CViElite Attendance, CViElite Jinji, CViElite Shinsei, CViElite My Number and CViElite Nencho.

Note that CViElite My Number must also be used when using PayrollPro.

Information Sharing Between Cloud Solutions

PayrollPro makes performing your complex payroll calculations simple.

And because it's a Cloud Solution, it's always there, ready to be used,

and up-to-date with the latest revisions to the law and regulations.

Features

Official document provision

PayrollPro can ease your burden in preparing official payroll ledgers, Income Tax certificates (gensen-choshuhyo) for the government, as well as periodical and non-periodical revision reports for Social Insurance premiums. And, a wide array of searches and Excel downloads can be performed.

Bilingual web pay slips

In addition to printed pay slips, employees can view and/or print their own pay slips directly from the web; and even more conveniently, they can access their web pay slips from a smartphone.

A database listing bank branches for verification of transfer details

A database listing all bank branches in Japan is updated monthly. This allows you to review personnel data updates or changes, like branch mergers, in order to verify a transfer prior to preparing bank deposits.

Web-based Year-end Tax Adjustments

Using CViElite Nencho, your employees can securely upload Year-end Tax data directly from the web. In concert with PayrollPro and CViElite Nencho, you can dramatically increase your efficiency for Year-end Tax Adjustment work.

Bank remittance data files

Salary, bonus, retirement allowance and inhabitant tax payment data can be downloaded in a standard format for bank disbursements.

Gross-up calculations

Gross-up calculation is available for all Clients using our Standard Cloud Solutions.

Advantages

Always the latest version

PayrollPro is automatically updated by CVi for the latest changes to Japanese laws and Regulations. That means when you use CVi, you are always using the latest version without having to do an upgrade. And when new features are released, they are immediately available to you.

Support for foreign employees

PayrollPro includes special support for complex requirement facing many multi-national and foreign-affiliated firms, such as gross-up calculations. This allows foreign employees to be included in regular payroll processing without requiring specialized handling. Also, printed web pay slips are available in English and Japanese.

Web Pay Slips

Pay slips can be printed or viewed online with bilingual Web Pay Slips (web statements). After payday, employees can access Web Pay Slips to view or print their pay slip (withholding slip) and bonus details.

FAQ

- So many companies have the same payday each month. Won't PayrollPro get overloaded?

- The answer is no. PayrollPro has a multitude of servers handling Client access, and a separate group of calculation servers which perform the tangible monthly payroll, bonus, Social Insurance and Year-end Tax Adjustment calculations. This allows for continuous and uninterrupted access to your payroll data. And, as Client volume grows, additional servers can be easily and securely added to increase capacity.

- Which formats can reports be exported to?

- Data can be exported to PDF or Excel files. Once the export file is created, it can then be saved or printed.

- Can you maintain data relationships with different accounting systems?

- Yes, payment deductions and accounting journal data can be exported to Excel files, allowing PayrollPro to easily work together with any accounting system which provides an import function.

For those Clients who wish to introduce a dedicated service

CVi's Standard Products and Services are provisioned for in a shared environment under strict information security policies, procedures and guidelines, including standards for the protection of personal information. This has allowed us to achieve a high level of service at reasonable rates that has satisfied Clients. In the shared environment, Client data is logically separated.

Notwithstanding, irrespective of how high a quality or comprehensive our standard range of services might be, these might still not 100% meet the requirements of a specific client. Hence, we offer a "Segregated Program" under which any of our standard services can be customized. If you are interested in a personalized service for any of the categories below, please contact us or your respective Sales Representative.

- Build a server and network operations in a Client-dedicated environment.

- Conduct a Client-initiated audit based on your security and BCP requirements.

- Use a Client-specific Agreement template instead of CVi's standard Agreement template.

- Other Client-specific services not covered under the Shared Service.